Navigating the complexities of your financial future can be a daunting task. With so many options and ever-changing market trends, it's easy to feel overwhelmed. This is where a skilled financial advisor becomes invaluable. India boasts a plethora of highly qualified financial advisors who can guide you towards your financial goals dreams. Whether you're looking to save for retirement, these top advisors possess the knowledge and expertise to create a personalized plan tailored to your unique needs.

Finding the right financial advisor is crucial, as they will be entrusted with shaping your prosperity. Consider factors such as their expertise in various investment strategies, communication style, and compensation structure. Don't hesitate to schedule consultations before making a decision.

Investing in a qualified financial advisor is an investment in your bright future. With the right guidance, you can navigate the world of finance with confidence and achieve your dreams.

Instant Personal Loans: Quick & Easy Funding at Your Fingertips

Need cash fast? Consider this instant personal loans! These easy financial options offer rapid access to the resources you need, all from the ease of your phone. With a hassle-free application process and speedy approval, you can get the money you need in as little as one day.

- Explore a variety of loan amounts to suit your requirements

- Favorable interest rates make borrowing affordable

- Benefit from convenient repayment options

If you need to cover unexpected costs, manage your debt, or simply have additional cash on hand, instant personal loans can offer the {financial{ support you need.

Propel Business Growth with Flexible Loans

Want to expand your business's reach but face limitations on traditional financing options? Consider the power of flexible loans. These funding solutions offer a efficient pathway to access resources without requiring guarantees. Whether you're aiming to invest in equipment, develop new talent, or launch a groundbreaking initiative, unsecured loans can provide the boost your business needs.

- Advantages of Unsecured Loans:

- Quick approval and funding process

- Elevated cash flow management

- Amplified flexibility for business growth

Secure Your Dream Home with Low-Interest Mortgages

Owning a dream home is a goal for many. Despite this, the cost of real estate can be daunting. Fortunately, current mortgage market offers attractive interest rates, here enabling homeownership more achievable. A low-interest mortgage can greatly minimize your monthly payments, freeing up money for other needs.

Before you begin on this journey, it's essential to carefully research different mortgage options and institutions. Contrast interest rates, terms, and fees to determine the optimal solution for your budgetary situation.

Finding The Best Loan Options in India: Compare & Apply Now!

Are you looking for a loan to fulfill your financial aspirations? With the numerous options available in India, it can be difficult to find the ideal fit. That's where our comprehensive loan comparison tool comes in!

- Easily compare interest rates and conditions from renowned lenders.

- Get customized recommendations based on your income profile.

- Submit your loan application virtually in just a few clicks.

Don't spend time with tedious applications. Start your journey to financial freedom today!

Financial Planning Simplified: Expert Advice for Every Goal

Navigating the world of finance can seem daunting. But, with a little know-how and the right strategy, you can master your financial journey and achieve your goals. This detailed guide provides actionable tips and strategies to help you manage your finances effectively, whether you're spending for retirement, a dream vacation, or simply want to enhance your financial future.

- Start by defining your financial goals. What do you hope to achieve?

Once, create a realistic budget to track your income and expenses.

- Consider different investment options that align with your risk tolerance and goals.

- Periodically review your plan and make adjustments as needed, as your circumstances evolve.

Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Loni Anderson Then & Now!

Loni Anderson Then & Now! Rachael Leigh Cook Then & Now!

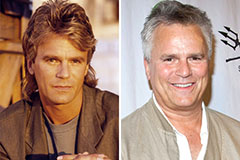

Rachael Leigh Cook Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!